“Vigilance Into Year-End”: Q3 2025 Market Perspective from Mainline Capital

- Matthew Hepburn

- Oct 1, 2025

- 4 min read

Updated: Oct 2, 2025

Q3 2025 Market Update & End of Year Outlook

Q3 in one line: Risk assets advanced on cooling-but-sticky inflation and a first Fed cut, even as shutdown risk and rich valuations argue for discipline.

Our clients at Mainline Capital continue to take advantage of market conditions using a systematic approach—including continuous risk monitoring and measured, client-specific allocation decisions—to support long-term investment goals.

Quarter in Brief — What went well

Equities: Q3 delivered broad gains: S&P 500 +7.79%, Nasdaq +11.24%, Dow +5.22%.

Fresh highs: Major U.S. indexes notched record closes in mid-September following the Fed’s rate cut.

Policy support: The FOMC cut 25 bps on Sept. 17, starting a gradual easing path (new target 4.00%–4.25%).

Rates backdrop: The 10-year Treasury ended the quarter near 4.16%, a modest drift lower from summer highs—supportive for equity multiples.

Market Health — The balance of evidence

Inflation: Headline CPI (Aug) 2.9% y/y; core CPI 3.1%. The Fed’s preferred core PCE (Aug) 2.9% with headline PCE 2.7%—cooler than 2023 but still above target

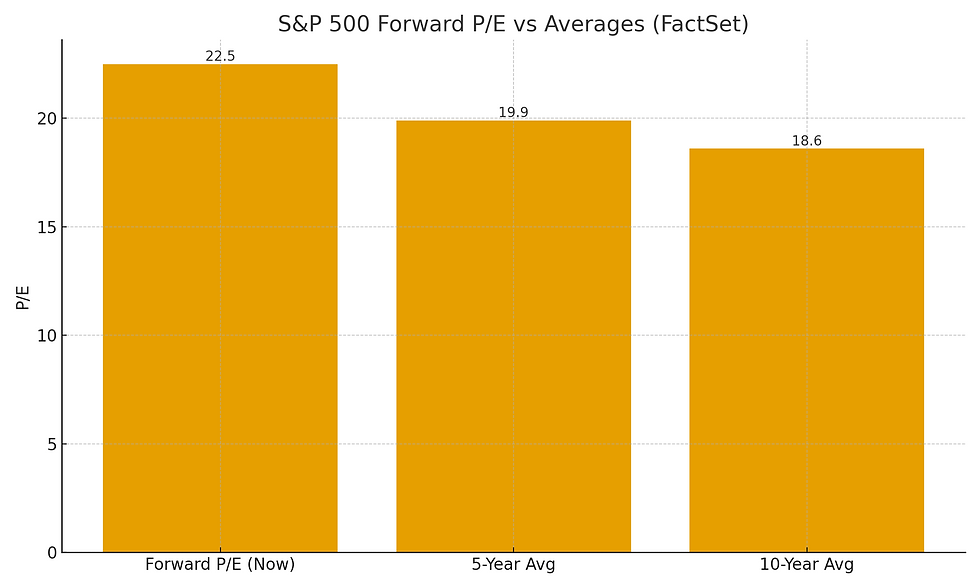

Valuation: The forward P/E ~22.5 vs 5-yr avg 19.9 and 10-yr avg 18.6—i.e., above trend and sensitive to earnings delivery and rates. (Some estimates peg it closer to ~23–24 into month-end.)

Rates & curve: Long rates eased into quarter-end; the curve is poised to steepen if easing continues and growth cools, a setup that often rotates leadership toward quality cyclicals and cash-flow compounders.

Policy Path & Near-Term Risks

Fed: After September’s cut, officials have signaled caution—open to further easing, but wary of moving too quickly while inflation remains above 2%.

Government shutdown: As of Oct 1, the federal government is shut down, which can delay official data (e.g., jobs/CPI releases) and inject event-driven volatility.

Data dependency: With delayed federal releases, markets may lean more on private indicators—raising the odds of headline-sensitive swings around interim estimates.

Valuation & Earnings: what the multiple is “paying for”

At ~22–23x forward on the S&P 500, the market is pricing resilient earnings and lower discount rates. Any miss—via slower profit growth, persistent services inflation, or a re-acceleration in long yields—could widen downside tails.

Still, record price levels reflect improving breadth, an AI-led capex cycle, and a Fed that’s transitioned to measured cuts rather than further hikes.

“Real-Money” Year-End Catalysts (flows, taxes, plumbing)

Buyback blackout & resumption: Corporate repurchases typically slow into earnings (early-to-mid October), then re-accelerate into Nov/Dec; corporates remain the largest net buyers in 2025 (≈ $1T). Expect a supportive bid as windows reopen.

Mutual fund distributions: Nov–Dec capital-gains distributions can create taxable surprises and mechanical selling in certain active funds—plan placement and offsets accordingly.

Quarter-/year-end rebalancing: Institutional rebalancing is predictable and price-moving; equity overweights can see sell-pressure around set windows, while underweights can trigger catch-up buying.

Seasonality: Q4 is historically the strongest quarter (avg ~2.9% since 1928), with “Santa-Claus-rally” dynamics late December—useful context, not a strategy.

What could go wrong (and right)

Key concerns

Inflation plateau: Services/core remain near ~3%, constraining the Fed’s glide-path.

Policy/error risk: A prolonged shutdown or a too-fast/too-slow Fed response could hit confidence and multiples.

Valuation sensitivity: Elevated P/E amplifies downside if growth or margins disappoint.

Offsetting supports

Easing cycle underway; long yields off the highs.

Earnings breadth improved into quarter-end; buybacks set to re-accelerate post-blackout.

Outlook — Year-End and Six-Month Preview (Q4 2025–Q1 2026)

Base case: Choppy but upward bias as easing + resilient profits offset policy noise. Expect volatility spikes in October, then improved liquidity as buybacks return and tax planning shapes flows into December.

Rates: A gradual Fed keeps the 10-year in a 4.0–4.5% range absent a growth shock; watch for curve steepening if cuts continue.

Inflation: Trend lower but sticky near ~3% core until housing/services cool further. That tempers the pace of cuts but supports a soft-landing narrative.

Earnings: Multiple depends on delivery—quality balance sheets, pricing power, and cash yield matter most at these valuations.

How we’re positioning (practical, risk-aware)

Core: Keep equity beta aligned with plan; lean quality growth + quality cyclicals; maintain risk-managed tilts given October’s event risk.

Income/defense: Ladder 2–7yr high-quality bonds; selectively add munis where after-tax yields are attractive.

Tactics: Expect to add on weakness as blackout lifts; manage tax lots around distribution dates; use defined sell disciplines with valuations elevated.

Client checklist (actionable)

Tax planning: Confirm distribution calendars; harvest losses where appropriate; coordinate RMDs and Roth-conversion windows with CPA.

Liquidity: Keep 6–12 months spending in cash/income ladders to buffer volatility.

Review risk: Ensure allocation still maps to your withdrawal rate and time horizon.

Next step: Book your Q4 review to align portfolio, taxes, and 2026 cash-flow needs.

We’ll continue to monitor economic shifts and adjust investment strategies so you can navigate Q4, the end of 2025 and the start of 2026 with confidence and flexibility.

Referral Note -

If you’ve found your relationship with Mainline Capital valuable, please consider referring friends or family who could benefit from our tailored, data-driven approach. We appreciate the trust you place in Mainline Capital and welcome the opportunity to help more individuals navigate their financial futures with confidence.

Disclosures & Disclaimer

This blog post is intended for informational purposes and does not constitute individual investment advice. Past performance is not a guarantee of future results, and all investing involves risk. Please consult a qualified professional before making any investment decisions based on this information.

Matthew Hepburn

Mainline Capital Investment Associates

(215) 805-1716